These Amendments = the Legislature’s “Get out of Jail Free” card. They’re asking you to “bust” their spending limits for them!

Voters, beware! You are being used to grow government! Here’s how:

The Texas Legislature wanted to spend more money than allowed by the Texas Constitution. They were constitutionally constrained from spending all the money by the Tax Spending Limit in the Texas Constitution, which limits spending growth of “state tax revenues not dedicated by this constitution” to no more than the growth of the state economy.

So, instead of doing it themselves, they are asking voters to change the state constitution, using you – the voter – to “bust” the state spending limits with the Constitutional Amendments on the November 7, 2023, ballot. They KNOW turnout for these amendment elections is very low and that most of the amendments pass!

If Texas voters fall for it, their approval gives the Texas Legislature the authority to permanently grow state government. If these amendments pass, it will increase spending by at least $13.8 Billion over the next two years.

How Does This Happen with a Republican-controlled Texas House and Senate?

Conservative spending hawk and subject matter expert on economic, regulatory, energy, and fiscal policy, Bill Peacock explains, “ The limits of the Tax Spending Limit can be exceeded if “approved by a record vote of a majority of the members of each house.” But voting to exceed the spending cap meant Texas politicians would be faced with another constraint – angry Texas voters who might object to their increasing spending by $56.5 billion while only putting $12.7 billion into property tax relief.”

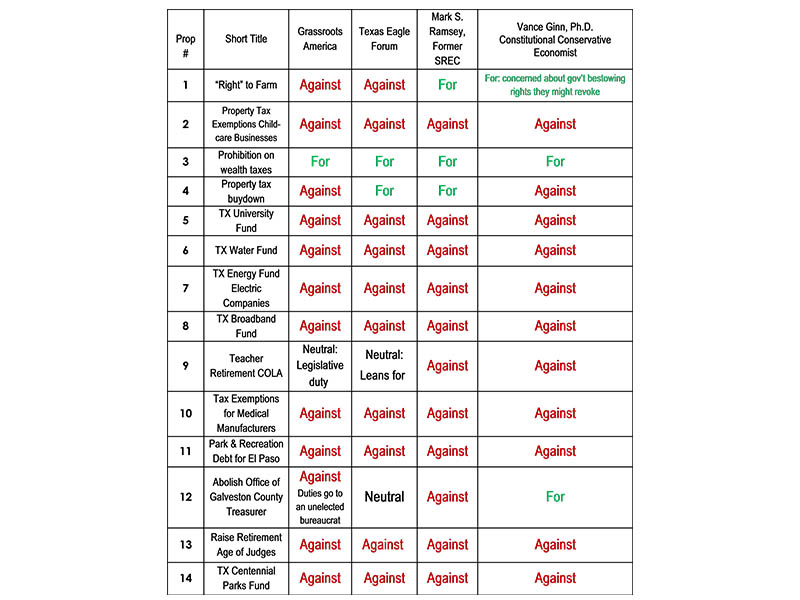

Meanwhile, conservative economist and Texas budget specialist Vance Ginn says that these spending propositions “will grow government with new funds dedicated outside of the spending limit without legitimate roles for government, and prop 4 would narrow the school property tax base by raising the homestead exemption, thereby necessitating higher tax rates – making it more costly for Texans and making it more complicated and longer to eliminate those taxes.”

You can fight back! You can say “NO” to growing state government.

Other Important Resources

Bill Peacock: Texans Can Shrink Government on Nov. 7

(to find your local election information)