Voter Guide – Nov 4th Constitutional Amendments

This is lengthy and detailed. It is important. How Texans vote shapes the future for generations. As you witness the violent chaos unfolding, you must remember that EVERY election is important to beat back the enemies of Liberty – those who are easily seen and those cloaked in good intentions. It is worth your time and effort to be an informed voter, esteeming what comes AFTER you far more important than any temporary personal benefit.

Protecting Liberty is no small matter.

Texas Constitutional Amendment Election

Election day: November 4th

Early voting: Mon. 10/20 – Fri. 10/31/25

Do We Really Want Limited Gov’t?

Constitutional Amendment elections are “get out of jail free cards” for the state legislature and the exective branch. Under the guise of “let the voters decide,” the ruling class and government-growing lobbyists convince legislators there’s a problem only government can solve. A constitutional amendment is the method they use to keep their fingerprints off the deed.

In the last 25 years, we’ve seen the “let the people decide” tactic drive numerous constitutional amendments that damaged individual liberty and exponentially increased off-budget spending. This is growing Texas government the sneaky way.

Constitutional amendments have become a tool that allows the Legislature to bypass statutory spending limits and constitutional constraints without passing comprehensive reform legislation. Box checked. Consequences ignored.

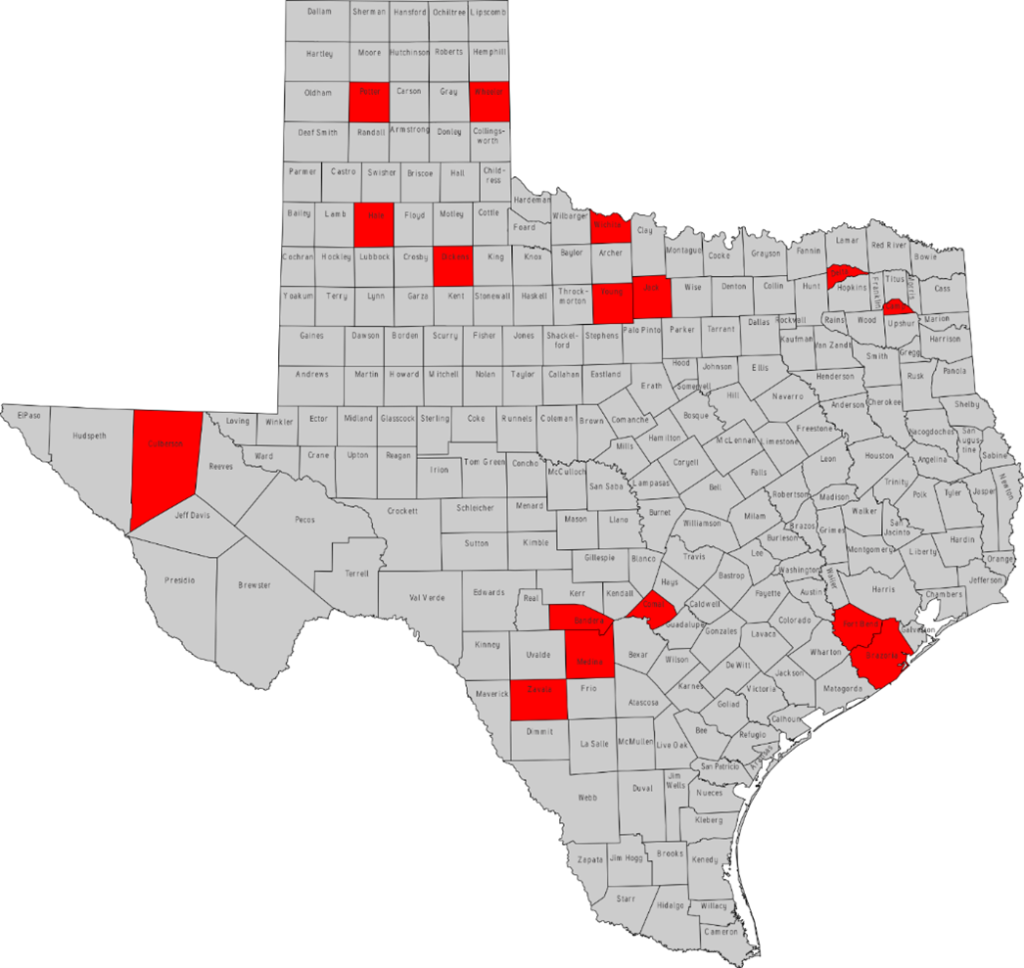

The architects of these amendments know that too few Texas voters pay any attention to amending the Texas Constitution. The average voter turnout for Texas constitutional amendment elections held in odd-numbered years between 1988 and 2023 was 11.1% of registered voters. This is significantly lower than the average turnout for general elections held in even-numbered years.

Keep this in mind – amending the Texas Constitution means that you believe the issue is worth saddling future generations with the consequences.

I urge you to be principled – not emotional – as you vote to amend our Texas Constitution.

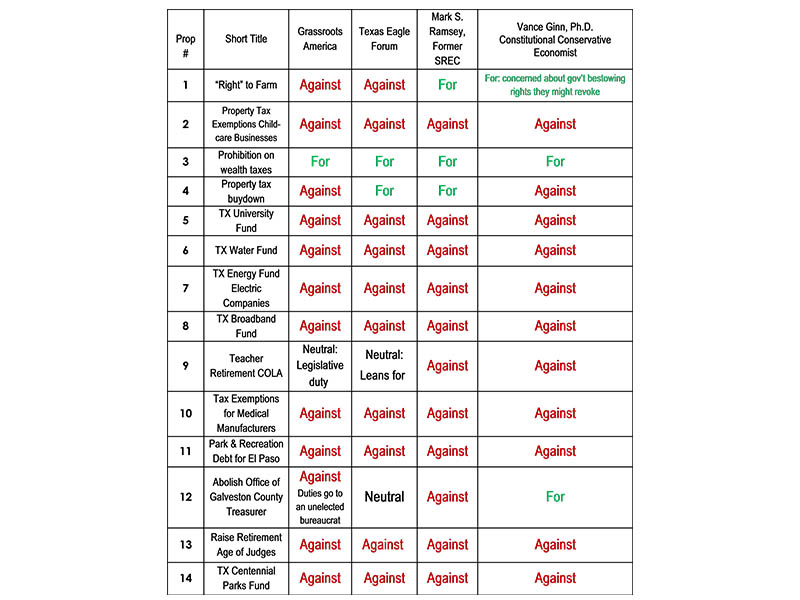

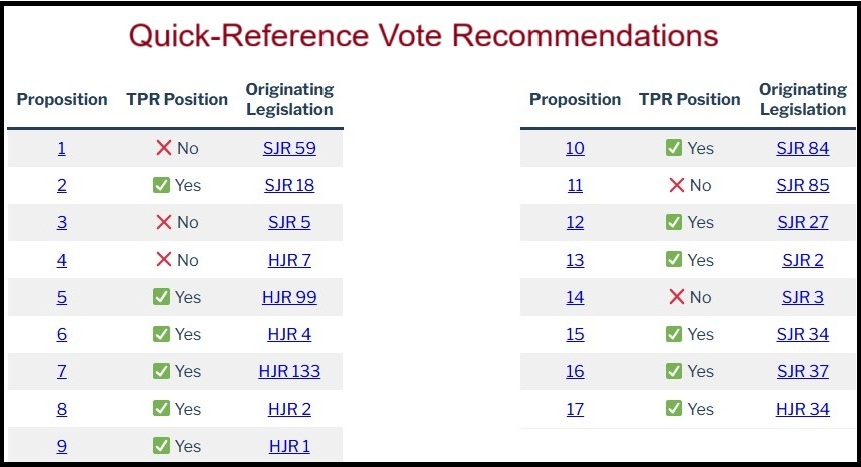

Ballot Guide & Vote Recommendations

Texas Policy Research | Jeramy Kitchen & Staff

Our Board of Directors reviewed the following ballot guides and recommendations from Jeramy Kitchen and his staff. (Jeramy is a subject matter expert in fiscal policy for us.) These are solid recommendations based on Liberty Principles. We endorse them. If you disagree, we don’t mind. This nation was founded upon vigorous, principled debate for future generations – not temporary convenience.

Proposition 1

Ballot Language: “The constitutional amendment providing for the creation of the permanent technical institution infrastructure fund and the available workforce education fund to support the capital needs of educational programs offered by the Texas State Technical College System.”

Summary: This amendment would create two dedicated state funds to support infrastructure, land acquisition, and equipment for the Texas State Technical College System (TSTC), seeded with an initial $850 million in general revenue tax dollars. These funds would operate outside the normal state budget and legislative oversight.

Texas Policy Research Recommendation: ❌ Vote No

Rationale: While expanding access to workforce education supports individual liberty and personal responsibility, embedding this funding in the Constitution undermines limited government and transparency. A statutory approach with normal budget oversight for fiscal accountability would be best.

Proposition 2

Ballot Language: “The constitutional amendment prohibiting the imposition of a tax on the realized or unrealized capital gains of an individual, family, estate, or trust.”

Summary: This amendment would permanently prohibit the TX Legislature from imposing any tax on capital gains, whether realized or unrealized. Texas currently does not have such a tax; this functions as a safeguard to preserve the state’s existing low-tax structure.

Texas Policy Research Recommendation: ✅ Vote Yes

Rationale: This measure upholds individual liberty, private property rights, and free enterprise by protecting Texans from future financial intrusion and double taxation. It strengthens Texas’s commitment to limited government and long-term economic competitiveness.

Proposition 3

Ballot Language: “The constitutional amendment requiring the denial of bail under certain circumstances to persons accused of certain offenses punishable as a felony.”

Summary: This amendment would authorize judges to deny bail to individuals charged with a list of serious felonies, such as murder, aggravated assault, and human trafficking, if the state proves by clear and convincing evidence that release would endanger the public or risk flight. It embeds mandatory bail denial for certain charges into the state constitution, with limited discretion for judges.

Texas Policy Research Recommendation: ❌ Vote No

Rationale: While aimed at improving public safety, this amendment undermines individual liberty by expanding pretrial detention without conviction and curtails judicial discretion. It creates a rigid, constitutionally enshrined mandate that risks overreach, erodes due process, and expands the scope of government authority without adequate safeguards.

[JoAnn Fleming added the following quote for additional context.]

Conservative judge and member of The Federalist Society, 114th District Court Judge Austin Reeve Jackson says, “Instead of giving judges the discretion that we want, and that a major majority of the public wants us to have – which is the discretion to deny bail for the most serious and violent offenders – it instead takes away our discretion and makes detention mandatory in cases where it is not always appropriate, while doing nothing to address the underlying harm of judges not having the authority to deny bail to violent and repeat offenders.

“This is yet another example of members of the legislature wanting to appear to do something about a problem without actually doing anything other than making it worse. Instead of doing the hard work of crafting legislation that would give judges, prosecutors, and defense lawyers the ability to better identify and act to detain the worst of the worst offenders, while also making it easier to get people out of jail who don’t belong there, they instead craft something that will make things harder for the people doing the work in the trenches – which also poses a serious risk of significantly and unnecessarily increasing detention costs to counties and their taxpayers.”

Proposition 4

Ballot Language: “The constitutional amendment dedicating a portion of the revenue derived from state sales and use taxes to the Texas Water Fund and to provide for the allocation and use of that revenue.”

Summary: This amendment would divert up to $1 billion per year in existing sales tax revenue into a new Texas Water Fund to support water infrastructure projects. The funding would occur automatically each year, bypassing the normal legislative appropriations process, and would continue until 2035 unless extended by the legislature.

Texas Policy Research Recommendation: ❌ Vote No

Rationale: While addressing water infrastructure is vital, this resolution undermines limited government and fiscal transparency by embedding automatic spending into the Constitution. It crowds out private-sector solutions, reduces future tax relief opportunities, and limits legislative accountability for long-term fiscal commitments.

Proposition 5

Ballot Language: “Constitutional amendment authorizes the legislature to exempt from ad valorem taxation tangible personal property consisting of animal feed held by owner of the property for sale at retail.”

Summary: This amendment gives the TX Legislature the authority to exempt animal feed held for retail sale from local property taxes. It does not require the exemption but permits future legislation to implement it, potentially correcting a tax inconsistency within the agricultural supply chain.

Texas Policy Research Recommendation: ✅ Vote Yes

Rationale: By reducing a targeted tax burden on agricultural retailers, this measure promotes free enterprise and strengthens private property rights. Though exemptions should be used cautiously, this amendment gives the Legislature flexibility to deliver fairer tax treatment without mandating new spending.

Proposition 6

Ballot Language: “The constitutional amendment prohibiting the legislature from enacting a law imposing an occupation tax on certain entities that enter into transactions conveying securities or imposing a tax on certain securities transactions.”

Summary: This amendment would preemptively prohibit the Texas Legislature from imposing taxes on securities transactions or from creating new occupation taxes on registered financial market operators like brokers and exchanges. It aims to shield such investors and financial institutions from future taxation.

Texas Policy Research Recommendation: ✅ Vote Yes

Rationale: This measure affirms limited government, free enterprise, and private property rights by protecting investment activity from targeted taxation. It preserves Texas’s pro-business climate without fiscal downside, safeguarding both institutional and individual investors from government interference.

Proposition 7

Ballot Language: “The constitutional amendment authorizing the legislature to provide for an exemption from ad valorem taxation of all or part of the market value of the residence homestead of the surviving spouse of a veteran who died as a result of a condition or disease that is presumed under federal law to have been service-connected.”

Summary: This amendment allows the Legislature to exempt the homestead of a surviving spouse of a veteran who died from a presumed service-connected condition. The exemption continues if the spouse remains unmarried and moves to a new qualifying homestead, carrying forward the previous tax relief.

Texas Policy Research Recommendation: ✅ Vote Yes

Rationale: This measure honors the sacrifices of military families and protects individual liberty and property rights. While such exemptions complicate the tax system, this narrowly targeted relief is justified. It should, however, be accompanied by broader property tax reform to maintain equity and simplicity.

Proposition 8

Ballot Language: “The constitutional amendment to prohibit the legislature from imposing death taxes applicable to a decedent’s property or the transfer of an estate, inheritance, legacy, succession, or gift.”

Summary: Permanently prohibits the Texas Legislature from imposing estate, inheritance, or gift taxes. Texas does not currently levy such taxes; measure acts as a safeguard to prevent future reintroduction.

Texas Policy Research Recommendation: ✅ Vote Yes

Rationale: Proposition 8 reinforces private property rights, personal liberty, and limited government by ensuring Texans are free to transfer wealth without punitive taxation. It prevents future overreach, supports family financial stability, and protects generational business continuity without affecting current revenues.

Proposition 9

Ballot Language: “The constitutional amendment to authorize the legislature to exempt from ad valorem taxation a portion of the market value of tangible personal property a person owns that is held or used for the production of income.”

Summary: This amendment would allow the Legislature to exempt up to $250,000 of the market value of income-generating personal property, such as business equipment or tools, from local property taxes. The exemption would ease the tax burden on small businesses and the self-employed.

Texas Policy Research Recommendation: ✅ Vote Yes

Rationale: Reducing taxes on productive assets, this measure promotes free enterprise, supports private property rights, aligns with limited gov’t principles; provides targeted relief to small businesses/entrepreneurs; encourages investment/job creation without direct costs on the state.

Proposition 10

Ballot Language: “The constitutional amendment to authorize the legislature to provide for a temporary exemption from ad valorem taxation of the appraised value of an improvement to a residence homestead that is completely destroyed by a fire.”

Summary: This amendment would give the Legislature authority to provide a temporary property tax exemption for homesteads that are entirely destroyed by fire. The exemption would apply only to the value of the destroyed structure, not the land, and would be implemented through future legislation.

Texas Policy Research Recommendation: ✅ Vote Yes

Rationale: Proposition 10 upholds individual liberty and private property rights by ensuring homeowners are not taxed on homes that no longer exist. It allows narrowly tailored, compassionate relief without mandating new programs or increasing government scope, consistent with limited government principles.

Proposition 11

Ballot Language: “The constitutional amendment authorizing the legislature to increase the amount of the exemption from ad valorem taxation by a school district of the market value of the residence homestead of a person who is elderly or disabled.”

Summary: Amendment authorizes the Legislature to raise the additional school property tax exemption for elderly/disabled homeowners from $10,000 to $60,000. The increased exemption would reduce school district taxes for qualifying individuals and be offset by state funds to maintain district funding levels.

Texas Policy Research Recommendation: ❌ Vote No

Rationale: Compassionate in intent, this shifts the tax burden onto younger and non-exempt Texans, expands state spending commitments without reform, erodes tax equity. True relief should come through comprehensive reform—not piecemeal exemptions that weaken limited government and fiscal discipline.

Proposition 12

Ballot Language: “The constitutional amendment regarding the membership of the State Commission on Judicial Conduct, the membership of the tribunal to review the commission’s recommendations, and the authority of the commission, the tribunal, and the Texas Supreme Court to more effectively sanction judges and justices for judicial misconduct.”

Summary: This amendment would expand and restructure the State Commission on Judicial Conduct (SCJC), increasing its membership and public representation, while enhancing its ability to issue public sanctions against judges. It also introduces new powers, including the authority to suspend judges upon indictment for certain crimes.

Texas Policy Research Recommendation: ✅ Vote Yes

Rationale: Proposition 12 promotes transparency, public accountability, and personal responsibility within the judiciary by broadening citizen oversight and strengthening enforcement of judicial ethics.

Proposition 13

Ballot Language: “The constitutional amendment to increase the amount of the exemption of residence homesteads from ad valorem taxation by a school district from $100,000 to $140,000.”

Summary: This amendment would raise the school district property tax exemption on homesteads from $100,000 to $140,000, reducing taxable home values and offering tax relief to homeowners. The state would reimburse school districts for the resulting loss in revenue.

Texas Policy Research Recommendation: ✅ Vote Yes

(with reservations)

Rationale: While this amendment provides short-term relief for homeowners, it does so by shifting the burden onto renters, small businesses, and non-exempt property owners. Broader tax reform, such as permanent M&O rate compression, would deliver more equitable and lasting relief across all Texans.

Proposition 14

Ballot Language: “The constitutional amendment providing for the establishment of the Dementia Prevention and Research Institute of Texas, establishing the Dementia Prevention and Research Fund to provide money for research on and prevention and treatment of dementia, Alzheimer’s disease, Parkinson’s disease, and related disorders in this state, and transferring to that fund $3 billion from state general revenue.”

Summary: This amendment would create a new state-run medical research institute and permanently dedicate $3 billion from general revenue, plus up to $300 million annually, for research and infrastructure related to dementia and other neurodegenerative diseases. The fund would exist outside the state’s regular spending cap, making the way for increased spending above the spending cap for each legislative session.

Texas Policy Research Recommendation: ❌ Vote No

Rationale: While well-intentioned, this amendment expands the scope and permanence of government by embedding medical research funding into the Constitution. It bypasses the appropriations process, undermines limited government, and risks crowding out private innovation in healthcare without clear fiscal safeguards or performance accountability.

Proposition 15

Ballot Language: “The constitutional amendment affirming that parents are the primary decision makers for their children.”

Summary: This amendment would enshrine in the Texas Constitution the inherent right of parents to care for and make decisions about their children’s upbringing. It would restrict state or local government interference unless justified by a compelling government interest using the least restrictive means.

Texas Policy Research Recommendation: ✅ Vote Yes

Rationale: Proposition 15 affirms individual liberty, personal responsibility, and limited government by codifying parental rights and ensuring state action is narrowly constrained. It empowers families to guide their children’s upbringing without unwarranted interference from public institutions.

Proposition 16

Ballot Language: “The constitutional amendment clarifying a voter must be a US citizen.”

Summary: This amendment would explicitly state in the Texas Constitution that only U.S. citizens may vote in Texas elections. While current law already limits voting to citizens, this measure codifies that restriction in the Constitution to prevent future legal or policy changes allowing non-citizen voting.

Texas Policy Research Recommendation: ✅ Vote Yes

Rationale: Proposition 16 affirms individual liberty and limited government by clearly tying voting rights to citizenship and civic responsibility. It acts as a constitutional safeguard with minimal fiscal impact, reinforcing electoral integrity and state sovereignty.

Proposition 17

Ballot Language: “The constitutional amendment to authorize the legislature to provide for an exemption from ad valorem taxation of the amount of the market value of real property located in a county that borders the United Mexican States that arises from the installation or construction on the property of border security infrastructure and related improvements.”

Summary: This amendment allows the Legislature to exempt from property taxation any increase in value to land in TX border counties that results from the addition of border security infrastructure. It is a narrowly tailored measure meant to avoid penalizing landowners for voluntary security-related improvements.

Texas Policy Research Recommendation: ✅ Vote Yes

Rationale: Proposition 17 respects private property rights, individual liberty, and limited government by preventing tax penalties for landowners who choose to invest in border security. While exemptions should be used sparingly, this one is well-targeted and permissive, offering relief without expanding state programs or spending.